Morgan Stanley’s Wealth Management Business: Past, Present And Future

The financial downturn of 2008 left an indelible mark on the U.S. banking system, with some of the largest banks of the pre-recession era succumbing to the crisis. While Lehman Brothers went bankrupt, others like Bear Stearns, Wachovia and Merrill Lynch saved themselves from a similar fate by merging with rival banking giants (JPMorgan, Wells Fargo and Bank of America, respectively). Even banks that emerged from the recession largely unscathed were forced to take a tough look at their business models in view of the stricter regulations that were adopted globally. For most banks, this resulted in a reduction in non-core and less profitable business units. However, the changes undertaken were much more elaborate for a few banks. Morgan Stanley stands out as one of them.

Morgan Stanley has worked hard over recent years to increase its focus on the less volatile wealth management business while downsizing its fixed-income trading business to free up capital and to comply with stricter regulatory requirements. The overall effect of these moves has been to fundamentally change the bank’s business model from predominantly investment banking to a more balanced one. This has been welcomed by investors, with Morgan Stanley’s shares seeing the largest gain among all U.S. banks for each of the last two years (see Morgan Stanley Gains Most Among Banking Giants For Second Consecutive Year).

In this article, we detail the extent of changes Morgan Stanley has undergone over the years while highlighting a scenario which could have a sizable impact on its share price in the near future.

- Morgan Stanley Stock Dropped 5% Yesterday, What To Expect?

- Trailing S&P500 By 31% Since The Start Of 2023, Will Morgan Stanley Stock Close The Gap?

- Up 10% In The Last One Month, What’s Next For Morgan Stanley Stock?

- Where Is Morgan Stanley Stock headed?

- What To Expect From Morgan Stanley Stock?

- What To Expect From Morgan Stanley Stock?

See our full analysis of Morgan Stanley

Morgan Stanley’s Revenues Have Largely Witnessed An Upward Trend…

Morgan Stanley reported record revenues of $34.3 billion in 2014, which represents a nearly 6% growth compared to the previous year. It should be noted that an important factor behind the sharp differences in revenue figure for 2011 and 2012 comes from the accounting gains/losses related to the bank’s revaluation of its own debt (DVA). To put things in perspectives, Morgan Stanley reported a DVA gain of $3.7 billion in 2011 and a DVA loss of $4.4 billion in 2012. Ignoring the impact of these accounting figures, one can see that operating revenues have risen steadily over the last five years.

… But There Has Been A Notable Shift In The Importance Of Various Revenue Streams

Between 2006 and 2014, Morgan Stanley’s wealth management unit has increased its contribution to the top line figure from under 20% to almost 45%. At the same time, the importance of FICC (fixed income, currencies and commodities) trading has fallen considerably as its share of revenues slumped from more than 30% in 2006 to just above 12% in 2014. Notably, the equities trading desk has not seen much change – contributing to around 20% of total revenues for both periods (see Morgan Stanley Leads U.S. Banks In Equity Trading Revenues For 2014).

This Has Had A Direct Impact On Morgan Stanley’s Pre-Tax Income Figures

Wealth management operations have clearly become the mainstay of Morgan Stanley’s business model – a situation far removed from the trading-dominated business model that was prevalent before the economic downturn of 2008. As can be seen here, wealth management was responsible for almost half of the bank’s total earnings before taxes (EBT) in 2014 as compared to a share of under 6% in 2006. We must add that although the trading business is no longer as lucrative as it was over the last decade due to stricter regulatory oversight in the industry, Morgan Stanley’s investment banking arm has suffered from several multi-billion dollar legal settlements over recent years. This has dragged down the EBT figure, so the operating performance has been better than what these figures portray.

We Expect This Distribution To Remain Largely Unchanged In The Future

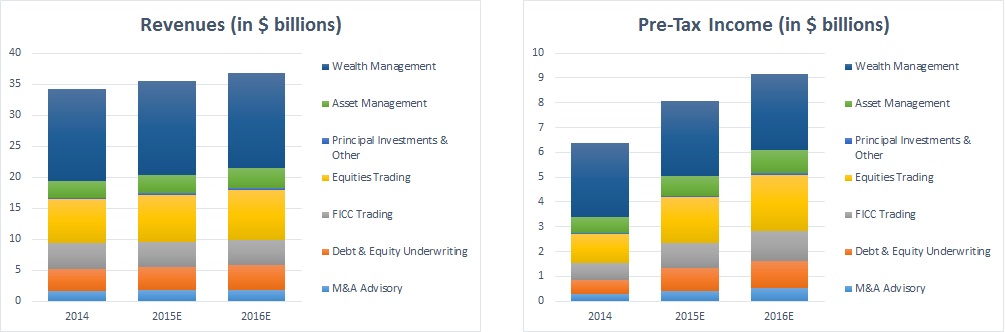

As investment banking operations should be unencumbered by these one-time charges over coming years, we expect margins to improve sharply over 2015-2016 before leveling out around 35% in the long run. Also, Morgan Stanley should be able to eke out some more profits from its wealth management unit in the near future – cementing the division’s position as the cornerstone of the bank’s business model. The chart below summarizes our estimates for Morgan Stanley’s revenue and EBT figures for each of the next two years:

We expect Morgan Stanley to make just under $36 billion in revenues for 2015, and $37.5 billion in 2016. Wealth management operations should contribute roughly 42-43% of this total figure for each year. A continued focus on cutting costs and removing legal backlog should allow the benefits to be magnified on the bottom line, as we expect the bank’s EBT to jump from $6.4 billion in 2014 to almost $8.3 billion in 2015 and further to $9.5 billion in 2016.

What Happens If Wealth Management Margins Stagnate?

Morgan Stanley has handsomely exceeded the expectations for its wealth management unit over recent years, and has been able to improve margins nearly each quarter since mid-2012. The bank struggled over 2010-2011 to integrate its legacy wealth management business with Smith Barney, and ended up with single-digit margin figures for the unit for each quarter over the period. The margin for this unit crossed 20% in late 2014. Given Morgan Stanley’s efforts to continue to cut costs, and considering the fact that rival Bank of America-Merrill Lynch has reported operating margins around 26% over the last two years, there appears to be some scope for improvement in this regard in the near future.

It should be noted that Morgan Stanley does not enjoy the strong cross-selling opportunities that Bank of America has due to its huge retail banking presence. So the pace of growth in Morgan Stanley’s client assets could slow down considerably over coming years from the current figure of 6%. It is also possible that operating margins for the division stagnate, or even contract, as the bank spends more to attract new clients. Considering a scenario where assets grow at 3% annually and the margin remain at the current level of 20%, the bank’s revenue and profit figures would be more along the lines of what we show in the following charts:

Under this assumption, Morgan Stanley will make just over $35.5 billion in revenues for 2015, and $36.8 billion in 2016 – a 3% reduction compared to our base case. The impact on the bottom line is larger, as the bank’s EBT would be $8 billion in 2015 and $9.2 billion in 2016 – 5% lower than the figures for our base case. You can see how this impacts Morgan Stanley’s share price in the near-term as well as in the long run by making changes to the chart below which captures the size of client assets held by the bank’s wealth management unit.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research