How Coke Is Restructuring Its Way To Higher Profitability

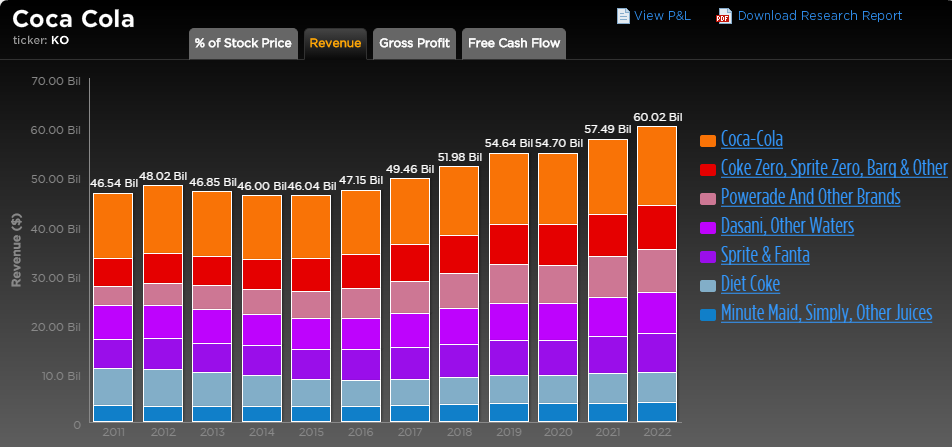

The Coca-Cola Company (NYSE:KO) is looking to restructure, consolidate some of its operations, and spin-off some others — all in a bid to drive operational efficiencies, reduce supply-chain costs, and improve profitability. These moves make sense for the world’s largest non-alcoholic beverage maker. The core business of carbonated soft drinks (CSD) can’t seem to catch a break in most of the developed world. The U.S. is approximately 45% of Coca-Cola’s net sales, and soft drinks contribute roughly 65% of the company’s valuation, according to our estimates.

We estimate a $43 stock price for Coca-Cola, which is above the current market price.

See our full analysis for Coca-Cola

- Should You Pick Coca-Cola Stock At $60 After Q4 Beat?

- Down 10% This Year Is Coca-Cola Stock A Better Pick Over AbbVie?

- What’s Next For Coca-Cola Stock After 4% Gains In A Week Amid Q3 Beat?

- Down 15% This Year Will Coca-Cola Stock Rebound After Its Q3?

- Which Is A Better Beverage Pick – Coca-Cola Stock Or Monster Beverage

- Pricing Actions To Bolster Coca-Cola’s Q2?

Coca-Cola has looked to drive revenues up through strategic pricing and pumping more money into advertising and promotions, but the fact remains that volumes in the CSD market continue to fall. In addition, Coca-Cola already accounts for a substantial 42.3% of the net volumes in an already somewhat saturated and mature U.S. CSD market, so it might be tough for the company to grow further organically. Expanding the non-carbonated lineup, deals with Monster and Keurig Green Mountain, entering new beverage segments such as milk with the Fairlife product — all are ways that Coca-Cola has looked to increase cash flow. The company is in its transitional period, it says, with many structural changes taking place to better align operations with the changing demands of the market place.

And the newest merger is an example of that.

Coca-Cola announced this month the combination of Coca-Cola Enterprises, Coca-Cola Iberian Partners, and the company’s subsidiary Coca-Cola Erfrischungsgetränke AG into one bottling company called Coca-Cola European Partners, which will be publicly traded on the Euronext Amsterdam, the New York Stock Exchange, and the Madrid Stock Exchange. What the consolidated bottling operations will do is trim the extra overhead costs, improve supply-chain efficiency, and leverage the best practices of each of the bottlers to improve service to customers and consumers across Western Europe — the company hopes.

The Europe operating group forms approximately 13% of Coca-Cola’s net volumes. CSD volumes have declined in the last three years for the company in the region, with a 3% decline last year. Europe revenues fell 7.5% year-over-year through the first half of this year, and operating income was down almost 4%. Coca-Cola European Partners expects to realize annual run-rate pre-tax synergies of $350 to $375 million within three years, by combining the bottling operations. Synergies following the combination will boost the company’s profitability. Coca-Cola European Partners is expected to generate around $12.6 billion in revenues and $2.1 billion in EBITDA this year.

A Little Bit Of History

In 2010, Coca-Cola acquired the former North America business of Coca-Cola Enterprises, and combined it with the management of the existing Minute Maid and Odwalla juice businesses, North America supply chain operations, and company-owned bottling operations in Philadelphia, Pennsylvania, resulting in a unified bottling and customer service organization called Coca-Cola Refreshments (CCR). Last year, the North America business was restructured into two operating units– Coca-Cola North America, which manages foodservice operations, and provides consumer marketing and innovation, and CCR.

And now Coca-Cola is in transition again, looking to refranchise two-thirds of its bottling territories in North America by the end of 2017, and a substantial portion of the remaining territories no later than 2020, in a bid to move away from the capital intensive and low-margin business of distribution. All this in hopes to improve operating performance.

Coca-Cola’s operating margins have dropped to 21.1% through the first half, from almost 24% a year ago, but this result has also been mostly impacted by unfavorable currency translations. The company’s margins remain higher than that of PepsiCo’s 18% margins, even though the latter includes its more profitable foods business as well. However, there is still some room to grow for Coca-Cola.

And now the company is looking to cut costs in Europe.

Coca-Cola is looking for a more consistent strategy for product development and market execution across Western Europe by unifying its bottling operations. The company expects to account for its stake of 18% in Coca-Cola European Partners under the equity method of accounting, and expects the merger to be slightly accretive to its 2016 comparable EPS. When growing is getting tough in the core CSD space, Coca-Cola is looking to transform in a way that its operational efficiency improves, subsequently boosting free cash flow. In the near term, unfavorable currency translations (Coca-Cola derives more than 50% of its net sales from outside the U.S.), are expected to cloud Coca-Cola’s financials. Continually falling consumption of sugary beverages, on the other hand, will be a long-term headwind. But through steps such as refranchising bottling operations in North America, and combining bottling operations in Europe, Coca-Cola might be looking at trimmed costs, and added supply-chain benefits going forward, which could push up margins.

See the links below for more information and analysis:

- Coca-Cola earnings review: strong organic growth reflects solid core business performance

- Bottled water is a potential growth category that can’t be ignored

- Soda makers wonder: where could growth in U.S. come from?

- Coca-Cola beats consensus estimates; delivers strong growth in Q1

- Negative currency translations overshadow PepsiCo’s strong organic growth in Q1

- Trefis analysis: Coca-Cola Coke U.S. Revenues

- Trefis analysis: Coca-Cola Diet Coke International Revenues

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research