What To Expect From J&J’s Full Year 2015 Earnings Announcement?

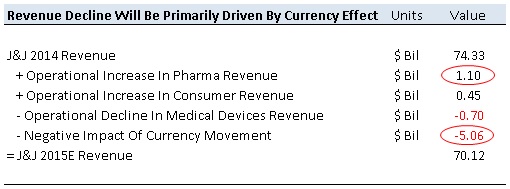

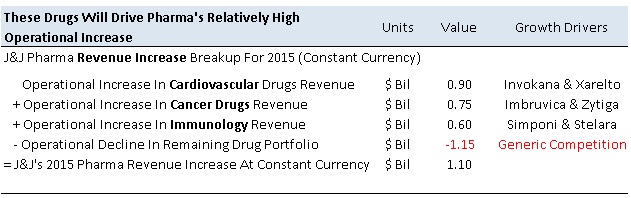

Where are we in relation to company guidance and consensus, as we approach the fourth-quarter and full-year earnings report? How will macroeconomic and currency effects be evident in the results, in relation to underlying business and product pipeline trends?

Here is what we expect from J&J’s full year 2015 earnings results.

See how we provide complex answers to hard questions with these direct and schematic responses.

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Here’s What To Expect From Johnson & Johnson’s Q1

- What’s Next For Johnson & Johnson Stock After A 6% Decline In A Month?

- Is Johnson & Johnson Stock A Better Pick Over AbbVie?

- Will Johnson & Johnson Stock Rebound To Its Pre-Inflation Shock Highs of $185?

- Should You Pick Johnson & Johnson Stock At $160?

Sources:

http://www.pharmatimes.com/Article/11-10-20/Diabetes_type_2_drug_market_to_nearly_double_by_2020.aspx

http://www.reuters.com/article/us-genmab-stocks-idUSKBN0L816E20150204

http://www.usitc.gov/publications/332/Torsekar_MedicalDeviceExportstoChina_FINAL.pdf

Have more questions about Johnson & Johnson? See the links below.

- Drugs, Devices, Consumer: What’s Johnson & Johnson’s Revenue and Earnings breakdown?

- What’s J&J’s Fundamental Value Based On Expected 2015 Results?

- How Increased Focus On Pharmaceuticals In The Last 5 Years Has Helped J&J?

- By How Much Can J&J’s Revenue And EBITDA Grow Over The Next 3 Years?

- What’s J&J’s Fundamental Value Based On Expected 2015 Results?

- How Much Revenues Can J&J’s Phase 3 Pipeline Add By 2020?

- What Percentage Of Its Revenue Could J&J Lose Solely Due To Patent Losses Over The Next 5 Years?

- If Remicade Biosimilar Hits The U.S. Market In 2017, Does J&J Face Any Meaningful EPS Decline?

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)