What The Johnson Controls-Tyco Merger Means For Everyone Involved

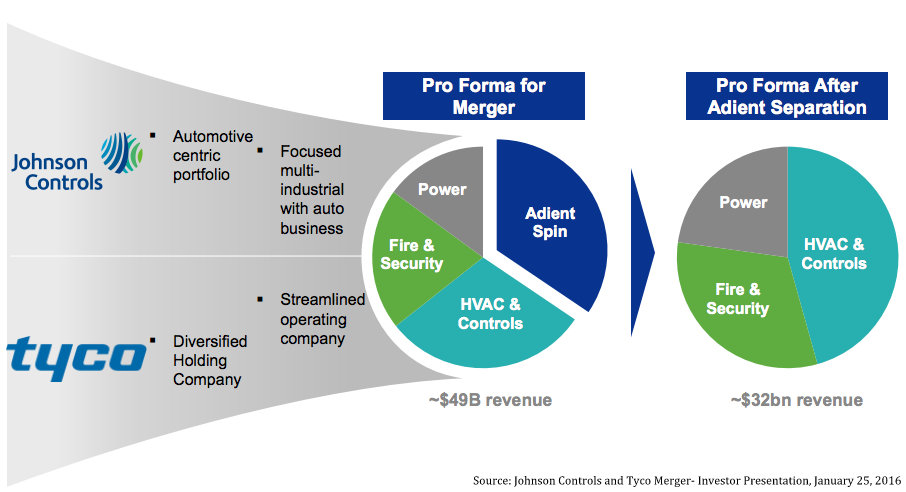

Johnson Controls (NYSE:JCI) recently announced a merger agreement with Tyco, a global fire and security provider, to create a combined company with $32 billion in revenues, post the Adient spin-off. [1] Under the terms of the agreement, Johnson Controls’ shareholders will hold a 56% equity stake in the combined company, and will receive a cash consideration of ~$3.9 billion, with Tyco owning approximately 44% of the equity. [2] The combination of highly complementary businesses facilitates the new company to offer comprehensive and innovative solutions to a wider market globally, across numerous end markets.

Click here to see our complete analysis of Johnson Controls

Comprehensive Portfolio Of Building And Energy Platforms

- Q4’23 Earnings Preview: Down 21% YTD Will Johnson Controls Stock Continue To Underperform?

- What’s Next For Johnson Controls Stock After An 8% Fall Yesterday?

- Margin Expansion To Drive Johnson Controls’ Q3?

- What’s Next For Johnson Controls Stock After An Upbeat Q2?

- Here’s What To Expect From Johnson Controls’ Q2

- Here’s What To Expect From Johnson Controls’ Q1

JCI considers the merged company, which will be the 14th largest industrial company in the U.S. by market capitalization, to be a highly strategic combination that creates a “leading full-scale building products and services business,” integrating exceptional product, installation, and service capabilities across controls, fire, security, HVAC (Heating, Ventilation, and Air-Conditioning), and power solutions. The main purpose of the merger seems to be gaining size in its area of focus, which is becoming a colossus in the building controls and equipment market. The new company will be able to witness immediate opportunities for growth, through cross-selling of products, complementary distribution networks, and a widened global reach. The geographic fit seems to be ideal, with JCI strong in the Chinese market, and Tyco effective in Europe.

The new company hopes to bring together complementary businesses to capitalize on the transitioning of the home-products industry into a new world characterized by smart, connected products, referred to as the ‘Internet of Things” (IoT). The two firms are building a business that possesses every facet of the so-called smart building, wherein everything from the air conditioning to light bulbs connected to the internet, with data being used for energy efficiency and productivity gains.

Inversion Deal To Result In Massive Tax Savings

The combined company is expected to furnish minimum operational synergies of $500 million over the first three years, after closing. According to Johnson Controls, this will be achieved by increasing efficiencies, removing redundancies, integrating global branch networks, and leveraging the combined scale of the $20 billion building’s business platform. However, according to analyst Julian Mitchell of Credit Suisse, the pre-tax operational savings estimated by the two companies is conservative, as the average ratio of such savings is usually about 7% of the target company sales, while in case of JCI-Tyco, the figure quoted is just 5%. [3] One of the reasons for this could be the “services-centric model” at both companies; 75% of Tyco’s revenues are from services, while the figure for JCI is 55%. Besides the above savings, tax synergies of over $150 million are expected as a result of the inversion deal, wherein the tax domicile of the new company will be shifted to Ireland, home of Tyco. In Ireland, the corporate tax rate is 12.5%, as opposed to the 35% in the U.S. In such a scenario, while the new company still has to pay U.S. taxes on U.S. income, it can avoid paying U.S. taxes on overseas income.

The JCI-Tyco merger has created a lot of controversy by moving its headquarters to Ireland, in order to avoid paying the higher American corporate tax rate. However, with a tax rate that is one of the highest in the developed world, along with the fact that the U.S. makes its companies pay that rate on all their global income, the inversion formula has seen a resurgence in the past few years.

A perverse result of this tax regime is that an independent U.S. company can end up paying higher taxes than an identical U.S. company owned by a foreign parent. [4] While neither Democrats nor Republicans like inversions, there is no consensus on how the problem should be solved, meaning a major overhaul of the tax system will not happen any time soon. When well-off U.S. citizens give up their citizenship, they are expected to pay an exit fee. However, when big U.S. companies shift their place of domicile, they are not required to pay any such fee. Hillary Clinton, a candidate for President of the United States in the 2016 presidential election, is proposing to apply an exit fee to companies that undertake corporate inversions. However, in the case of JCI, wherein U.S. shareholders will hold less than 60% of the combined company, such a ruling will not be applicable. In a conventional inversion, where holders of the U.S. firm hold more than 60% of the combined company, the inverted firm can’t get tax-free access to its cash. However, by structuring a deal that gives investors less than 60% of the ownership, they have side-stepped such regulations. Businesses look for any means to cut costs and pay fewer taxes. At the moment, the path chosen by a few is corporate inversion; and this practice will continue until significant tax reform takes place. While most talk regarding the merger is focused on the inversion, the savings generated from the synergies of the complementary businesses will also prove to be beneficial for not just the company, but also its shareholders and the customers at large.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research