2015 Earnings Review: JetBlue’s Earnings More Than Double As Fuel Costs Remain Low

JetBlue Airways’ (NASDAQ: JBLU) stock price traded 7% higher on Friday, after the airline posted stellar full year 2015 financial performance, backed by rapid capacity expansions and sustained decline in fuel costs during the year [1]. The New York-based airline’s top line growth was driven by strong domestic demand and focused capacity additions, while its bottom line grew largely because of the fuel cost savings and operational efficiencies realized during the year. Further, the low-cost carrier’s domestic operations enabled it to remain somewhat immune to the foreign currency headwinds in 2015, unlike its peers. In 2016, the domestic carrier aims to launch several revenue enhancing initiatives, such as offering its service to Boston and Cuba, a cabin restyling program, and expansion of its premium Mint service to new markets, which will allow it to capture a larger share in the market going forward [2]. In this note, we provide the key highlights of JetBlue’s 2015 earnings release and its outlook going forward.

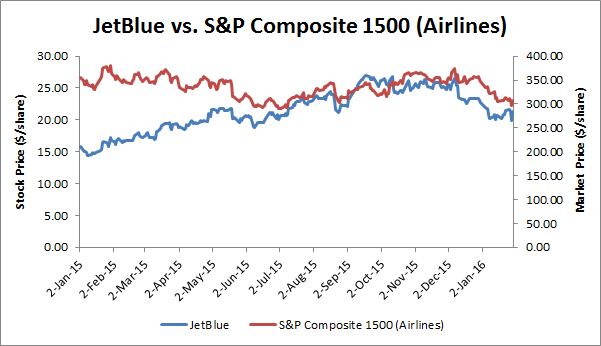

Source: Google Finance

Rapid Capacity Growth And Enhanced Operational Performance Drive JetBlue’s Revenue

- Gaining Over 20% This Year, What Lies Ahead For JetBlue Stock Following Q1 Results?

- Should You Pick JetBlue Stock At $6 After Q4 Beat?

- What’s Next For JetBlue Stock After A 35% Fall This Year?

- Here’s What To Expect From JetBlue’s Q2

- Will JetBlue Stock Recover To Its Pre-Inflation Shock Highs?

- What Led To A 62% Fall In JetBlue Stock Since 2019?

Unlike the legacy carriers who restricted their capacity due to the fear to oversupply of seats in the market, JetBlue continued to grow its capacity at a high rate in 2015 to expand its markets share. The airline grew its capacity by 9.5%, which is the second highest capacity growth in 2015, after Alaska Air. Further, the airline managed to attract 10.3% more passengers compared to 2014, implying that there is strong demand for its increased capacity. Moreover, JetBlue saw a slight improvement in its load factor (occupancy rate), which augmented its top line growth. Driven by the capacity additions and subsequent operational efficiencies, the airline’s revenue rose to $6.4 billion in 2015, 10.3% higher than 2014.

Fuel Cost Savings Boost Margins

Similar to its counterparts, JetBlue enjoyed significant reduction in its fuel costs due to the ongoing oil slump. The low-cost carrier’s fuel cost declined by more than $1 per barrel and averaged at around $1.93 per barrel, translating into fuel cost savings of $564 million during the year. However, these cost savings were partially offset by the marginal increase in the airline’s unit costs (excluding fuel costs and special items). Overall, JetBlue reported operating income of $1.2 billion, more than double the previous year. This resulted in operating margin of 19% in 2015, representing an improvement of 10 percentage points compared to 2014, which is the highest margin growth in the US airline industry.

Strengthening The Balance Sheet

JetBlue made efficient use of the increased cash flows from lower fuel costs during 2015. Firstly, the airline invested on revamping its current fleet by leasing six A320 aircraft for a total of 110 million, which would result in future annual rental savings of 12 million. Secondly, the carrier worked towards creating a leaner capital structure. For this, the carrier reduced its net debt by over $560 million, which led to a reduction in its net debt to EBITDA ratio from 2.5 times at year end 2014, to 1.1 times at year end 2015. Going forward, JetBlue estimates its scheduled debt payments to be around $51 million in the first quarter of 2016 and $454 million for the full year. Finally, the airline invested heavily in purchasing its own shares in order to create value for its shareholders. The airline repurchased 9.8 million shares for approximately 227 million during the year. The airline indicated that it would continue to explore opportunities to return value to its shareholders in the future. This implies that the airline is willing to share its growing profits with its investors.

See Our Complete Analysis For JetBlue Airways Here

Guidance For 1Q16 And Beyond

With a weak outlook for oil price markets, JetBlue remains optimistic about its prospects going forward. Consequently, the airline aims to expand its system capacity by 14%-16% in the first quarter, subject to extreme weather conditions, particularly in Fort Lauderdale. For the full year, the low-cost carrier plans to grow its capacity by 8.5%-10.5%. On the cost side, the airline forecasts fuel costs to remain low during the March quarter, estimating its fuel cost to average at around $1.12 per gallon for the quarter. However, the carrier expects its unit costs (excluding fuel costs and special items) to remain flat to a decline of 2% in the next three months.

On the whole, we expect JetBlue’s earnings to continue to grow on the back of fuel cost savings and aggressive capacity expansions.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- JetBlue Announces 2015 Results, 28th January 2015, www.jetblue.com [↩]

- JetBlue’s 2015 Earnings Transcript, 28th January 2015, Seeking Alpha [↩]