Gap Inc Is Gradually Losing Its Share In The U.S. Apparel Market To Fast-Fashion Counterparts

The apparel retail landscape in the U.S. is highly developed and competitive with a number of specialty brands, department stores and multi-brand chains competing against each other on design, variety and price. Over the last few years in particular, affordable fast fashion chains such as Zara and Forever 21 have taken considerable market share from specialty retailers. Even Gap Inc (NYSE:GPS), one of the bigger players in the industry, has seen its share in the U.S. apparel market drop from 5.1% to 4.7% over the past five years, despite performing better than other casual brands.

It is unlikely that the company will be able to reverse this trend soon, given that apparel retailing is rapidly shifting to online space and store based retailers’ foray in this arena is relatively slower. In fact, Gap Inc’s store consolidation strategy has made it almost certain that its market share will continue to go down. Since it cannot easily recover its market share from fast fashion players, it needs strive hard just to stay ahead of other casual apparel brands.

Our price estimate for Gap Inc is at $47, implying a premium of about 20% to the market price.

See our complete analysis for Gap Inc.

Gap Inc’s Position Is Relatively Strong

Despite being one of the bigger apparel players in the U.S., Gap Inc holds less than 5% market share, which clearly indicates the diverse nature of the U.S. apparel industry. Higher shares are held by multi-brand retail chain Macy’s (NYSE:M) (9%) and general merchandise retailer Wal-Mart (NYSE:WMT) (over 7%). JCPenney (NYSE:JCP) (3.3%) and Target (NYSE:TGT) (5.4%) also hold a similar portion of the market, and American Eagle Outfitters (NYSE:AEO), Aeropostale (NYSE:ARO) and Abercrombie & Fitch (NYSE:ANF) together account for just over 2% of total U.S. apparel sales. The remaining share belongs to numerous specialty and private label brands, fast-fashion players, department stores and pure play online retailers. Market share data for fast fashion retailers Zara and Forever 21 is not available since they are privately held companies. The illustration below provides a rough idea about the apparel retail landscape in the U.S.

*Market share is calculated using industry data available with the U.S. Census Bureau and annual filings of the companies under discussion.

With market share at less than 5%, Gap Inc’s position in the market may not appear too formidable, but it must be noted that the company has managed to grab this share with only three main brands in its arsenal. Players who have comparable or a higher market share are multi-brand retail chains, general merchandise retailers and supermarkets who usually offer a number of national and private label brands. Other specialty players such as American Eagle, Aeropostale and Abercrombie are significantly smaller than Gap Inc. Considering this, Gap Inc’s position does look strong, but it has been losing its footing over the past few years with growing competition.

Gap Has Been Losing Share

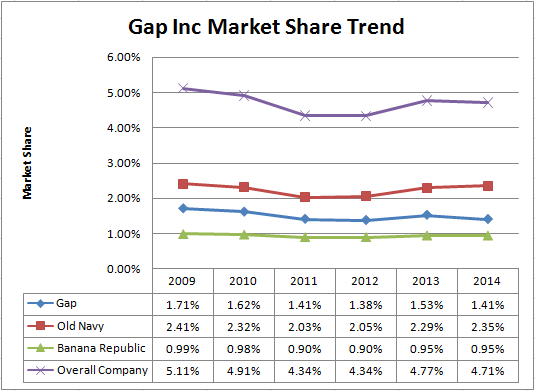

Once the most sought-after casual apparel brand, Gap Inc started losing its touch after the recession when U.S. buyers gradually moved to fast-fashion players in search of relatively fashion forward merchandise. Though the company consistently reported positive growth until 2014, it lost market share to fast-fashion players – Zara and Forever 21. Buyers across the industry moved away from casual clothing to affordable fashion merchandise, and Gap Inc among others was negatively impacted by this trend. The retailer’s share in the market fell from 5.11% in 2009 to 4.34% in 2012. Though the figure improved to 4.77% in 2013 driven by physical store expansion of Athleta and acquisition of Intermix, it fell again to 4.71% in the subsequent year. Ignoring the minor increase on account of Athleta and Intermix, Gap Inc’s share in the market has declined consistently. The chart below indicates how the market share of its individual brands has trended over the past five years.

It is interesting to note that Old Navy has almost retouched its 2009 level market share, thanks to its consistent good performance. However, persistent weakness in Gap and Banana Republic have more than offset the marginal growth in Old Navy’s market share. While the decline in the retailer’s market share has been gradual, it is falling nonetheless and the chances of revival are slim.

Chances Of Trend Reversal Are Thin

The main reason behind Gap Inc’s falling market share is growing buyer affinity towards fast-fashion brands and the ongoing online shift. Simply put, its merchandise is seen as less fashionable these days and the company has yet to reverse this perception. Although casual brands are trying to recreate their respective merchandise portfolios in order to ward off competition from fast-fashion players, apparel chains such as Zara and Forever 21 will most likely remain prime choices for customers seeking fashion-forward merchandise. Hence, we believe that Gap Inc’s market share in the U.S. will continue to fall. Also, with an increasing number of buyers shifting to online shopping and Gap Inc’s progress on this front being slow, its growth is likely to lag behind that of the industry’s. This adds more substance to our prediction for the company’s market share in the future.

However, Gap Inc still remains among the most preferred destination for casual apparel in the market, where buyers continue to elude American Eagle, Abercrombie and Aeropostale. Hence, even though Gap Inc may not succeed in outsmarting its fashion-forward counterparts, it still can arrest the decline in its market share to a certain extent with disciplined inventory control and consistency in trend- and season-relevant product launch.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap |More Trefis Research