Facebook Posts Solid Q4 Results On Rising Ad Pricing and Mobile Usage

Facebook (NASDAQ:FB) significantly outperformed expectations in the fourth quarter of 2015, both in terms of financial and engagement metrics. The company registered 52% growth in revenue over the prior year quarter to over $5.84 billion, against a Reuters compiled consensus estimate of $5.36 billion. Operating income more than doubled to $2.56 billion and the company’s operating margin improved from 29% in Q4 2014 to 44% in Q4 2015. This helped Facebook post robust 116% year-over-year (y-o-y) earnings growth in the quarter to 54 cents a share. In terms of engagement metrics, there was 3% sequential growth each in Facebook’s daily active users (DAUs) to 1.04 billion and monthly active users (MAUs) to 1.59 billion. To put this in perspective, this means that over 20% of the world’s population logs in to Facebook at least once a month. This ratio varies from over 60% in the U.S. and Canada to 14% in the Asia-Pacific region.

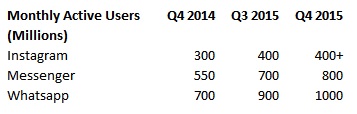

Facebook’s monthly active user base rose at a healthy pace on all platforms, including Instagram, WhatsApp and Messenger. The company reiterated the growing importance of video in content consumption on the Facebook website, with 8 billion video views per day amounting to over 100 million hours of total daily video time. These results are encouraging, and we expect that Facebook will continue to account for a larger share of the rapidly growing digital advertising market going forward. This is because the company’s product offerings have become highly popular with businesses of all sizes. Facebook’s long-term outlook looks strong on the back of strong monetization opportunities on its platforms as well as inroads into new areas such as virtual reality.

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

See our complete analysis for Facebook

Active Monthly User Base Swells to 1.59 Billion

Facebook continued to see a healthy increase in engagement metrics during the fourth quarter, as its monthly active users (MAUs) grew by 14% y-o-y to 1.59 billion and the average daily active users (DAUs) grew 17% y-o-y to 1.o4 billion. Therefore, the share of active monthly users who log in daily was around 65% in the fourth quarter, which is similar to the figure in the prior quarter as well as the previous year. This means that Facebook has been successful in consistently engaging a majority of users on a daily basis by improving their online experience through mobile usage, better content and an engaging News Feed.

Ad Pricing, Ad Impressions Drive Revenues

Owing to its swelling user base, Facebook’s Q4 2015 advertising revenues rose by 57% to $5.64 billion. The mobile platform accounted for a bulk of the growth, as mobile advertising revenue increased by 82% y-o-y to $4.5 billion driven by a 56% surge in mobile-only monthly active users. In contrast, the PC advertising business continued to decline in high-single digits. [1] Owing to the secular shift towards mobile advertising and rapid growth in advertising on Instagram, the share of mobile in Facebook’s overall ad business increased to 80% by the end of last quarter. We expect this to rise to nearly 90% by the end of 2016.

The consistently rising user base – particularly the mobile user base – helped improve the average ad pricing by 21% y-o-y and increase ad impressions by 29% y-o-y in the quarter. This was also the first quarter since Q3 2013 that Facebook’s total ad impressions increased on a y-o-y basis. Going forward, we expect both ad impressions as well as ad pricing to improve further. This should help improve the company’s average revenue per user (ARPU) as well. In the fourth quarter, Facebook’s worldwide ARPU increased 26% sequentially and 33% y-o-y to $3.73.

Long Term Potential Looks Solid

Rapid growth in video consumption represents a tailwind for Facebook’s business – daily video views have now increased to over 8 billion as compared to 4 billion at the end of March 2015. This drastic surge in video consumption should help shift a portion of TV ad budgets to Facebook and will lead to increased ad pricing on the platform.

Engagement growth on Instagram, Messenger and Whatsapp – where MAUs recently increased to over 400 million, 800 million and 1 billion, respectively – also add to the company’s long-term outlook. It was encouraging to note that 98 of the top 100 advertisers on Facebook also chose to advertise on Instagram in the last quarter.

Virtual reality (VR) represents another area of long term growth for the company, and it is expected to ship its Oculus VR headsets to over 20 countries in the next two months. With all of these promising growth areas, we expect Facebook’s top line to rise at a robust pace over our forecast period.

We are in the process of revising our $109 price estimate for Facebook’s stock.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Facebook (FB) Mark Elliot Zuckerberg on Q4 2015 Results – Earnings Call Transcript, Seeking Alpha, January 28 2016 [↩]