Why Dr Pepper Is Doing Better Than Coca-Cola And PepsiCo

Dr Pepper Snapple (NYSE:DPS) is the perpetual third behind The Coca-Cola Company (NYSE:KO) and PepsiCo (NYSE:PEP) in the U.S. carbonated soft drinks (CSD) market, which has been shrinking for 10 consecutive years now, however CSDs still constitutes as much as 41% of the 31 billion gallon liquid refreshment market. CSD is the most crucial segment for Dr Pepper, too, forming 80% of net volume sales for the beverage maker, even though customers continue to shift away from calorie-filled sodas to other beverages such as sports and energy drinks, ready-to-drink tea and coffee, and bottled water. Soft drinks are pivotal to Dr Pepper’s growth, and so is the domestic market, constituting nearly 90% of the top line. Both Coke and PepsiCo have strongholds in most beverage markets around the world, but here’s why Dr Pepper is faring better than its chief competitors as of now:

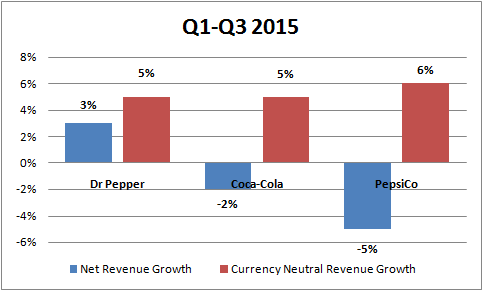

Currency Headwind Is More Pronounced For Coke And PepsiCo

Only 12% of Dr Pepper’s top line is formed by international markets. In 2014, 4% and 8% of net sales came from Canada, as well as Mexico and the Caribbean, respectively. While American multinationals have been struggling this year to convert their strong organic growth into realized revenues due to the continuously strengthening U.S. dollar, Dr Pepper’s major dependence on the home market has played to the company’s advantage. Currency was only a 2% headwind for Dr Pepper through the first three quarters, allowing net sales to grow positively by 3% in the quarter and year-to-date. On the other hand, markets outside the U.S. form approximately 55% and 50% of net sales for Coca-Cola and PepsiCo, respectively. As crucial foreign currencies such as the euro, Brazilian real, and Russian ruble continue to depreciate against the dollar, Coke and PepsiCo’s top lines were negatively affected by 7 and 11 percentage points this year, respectively.

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

Coca-Cola and PepsiCo have reported negative top line growth through the first nine months of this year, as currency conversion has hurt these companies. Not so much for Dr Pepper though, as the Texas-based company is not as exposed to the risk of currency translations.

We have a price estimate of $84 for Dr Pepper Snapple, which is below the current market price.

See Our Complete Analysis For Dr Pepper Snapple

Dr Pepper’s Performance In U.S. CSDs Remains Solid

Dr Pepper’s volume growth, even for CSDs, has outpaced the industry so far this year. The brand Dr Pepper remained flat in Q3, with regular Dr Pepper growing 2% and Diet Dr Pepper declining 4%. Both the 2% gain in regular and 4% decline in diet represents better than overall category performance. Volume growth in the CSD market is hard to come by, and is made even tougher due to the dominance of Coca-Cola and PepsiCo, which together account for almost 70% of the segment volumes. However, Dr Pepper has been able to consistently improve its volume share in an otherwise mature CSD market. Currency neutral organic sales for the quarter rose 5% year-over-year in Q3 and year-to-date, on a 3% increase in sales volumes, and 3 percentage points of favorable product and package mix and price increases.

And there is still more room for Dr Pepper to grow in terms of pricing. The company’s price mix is still lower than that of Coca-Cola and PepsiCo, both of which have gained from the introduction of several smaller packages, which have higher prices per unit. A very small percentage of Dr Pepper’s bottle can volume in the U.S. is in the small cans, such as the 8 ounce and 8.5 ounce packs. The customer is moving towards smaller bottles and cans, which contain lower cumulative calories, and so is the company. Dr Pepper might be late to arrive at the party, but if and when it does, it will have more room to grow. And considering that the company is already growing by more than its almost-omnipresent competitors, this puts the company in a good position.

The performance in U.S. CSDs and lower exposure to overseas markets is why Dr Pepper is growing more than both Coca-Cola and PepsiCo. In addition, Dr Pepper also has promising brands in the non-sparkling segment, which is growing as customers shift away from sparkling beverages. Allied brands such as Bai5, Vita Coco, etc., have contributed positively to Dr Pepper’s profitability. Through the first three quarters, while Coca-Cola and PepsiCo reported net revenue declines of 2% and 5% year-over-year, respectively, Dr Pepper reported an increase in net sales by 3%. Dr Pepper is the cheapest of the three stocks, going by the P/E ratios for the companies, but seeing how the company is growing by more than its competition, one would think that this stock holds solid potential.

See the links below for more information and analysis:

- Dr Pepper Snapple earnings review: strong organic growth across sparkling and non-sparkling segments

- Coca-Cola earnings review: another quarter where growth gets wiped out by currency translations

- PepsiCo earnings review: core performance remains strong, although marred by structural changes

- Bottled water is a potential growth category that can’t be ignored

- Soda makers wonder: where could growth in U.S. come from?

- The strong dollar is weighing down these large beverage companies

- Trefis analysis: Dr Pepper North America CSD Revenues

- Trefis analysis: PepsiCo Soft Drink Revenues

- Trefis analysis: Coca-Cola Revenues

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research