Fed Stress Test For Banks: Rationale, Results & Implications

The Federal Reserve released the results of the first phase of its annual Comprehensive Capital Analysis and Review (CCAR) for banks late last week, and all 31 financial institutions which were tested successfully cleared the regulatory hurdle. ((Federal Reserve releases results of supervisory bank stress tests, Federal Reserve Press Releases, Mar 5 2014)) The fifth iteration of the Fed’s stress tests featured more firms than any of the previous versions, and marks the first time when each participating firm proved that it is sufficiently capitalized to withstand an economic downturn – at least under the adverse conditions thrown at them by the financial regulator. This represents a sharp improvement in the stability of the U.S. banking sector over recent years.

There were some notable changes to the stress test this year compared to the previous year. The number of bank holding companies (BHCs) tested increased from 30 last year to 31 in 2015, with Deutsche Bank being included for the first time. Also, the Federal Reserve introduced a new set of “severely adverse scenarios” as a part of the stress tests in an attempt to understand how the banks fared under economic conditions which were significantly worse than those used as a part of the older tests.

In this article, which is the first in our series on the Fed’s stress tests and its implications for the biggest banks under review, we simplify the key points to put these tests in perspective and also summarize the results to help understand how the firms fare with respect to each other.

See Full Analysis for: Bank of America | Goldman Sachs | JPMorgan Chase | Morgan Stanley | Citigroup

Understanding The Test Scenario

Since it was first conducted in 2009, the Federal Reserve’s annual Comprehensive Capital Analysis and Review (CCAR) for banks has been tracked quite closely by banks, lawmakers, investors and also the public at large. This is because the review process – and specifically the stress test conducted as a part of it – is an important tool in the financial regulator’s arsenal to ensure that the country’s financial system can withstand an extreme adverse economic scenario in the future. As these tests aim to gauge the strength of each of the country’s largest financial institutions under conditions similar to those seen during the economic downturn of 2008, they help the Fed advise individual firms about how much they need to shore up their balance sheet if necessary.

The purpose of the stress test is to ensure that the banks have enough capital to lend to customers and businesses even under extremely trying economic conditions. The test scenario includes 28 variables (increased from 26 last year) that capture various aspects of the global economy. [1] Of these, 16 variables relate to the domestic economy and the rest are international variables.

The table below summarizes the main domestic variables considered by the Federal Reserve for the stress test. The most recent value of each of these variables is shown alongside the worst-case figure for each of them under the “adverse” as well as the “severely adverse” scenarios.

| Variable | Most Recent Value | Adverse Scenario | Severely Adverse Scenario |

| U.S. Unemployment Rate | 5.5% (February 2015) | 7% | 10% |

| Real GDP Growth Rate | 3.2% (Q4 2014) | -1.50% | -6% |

| National House Price Index | 166.82 (February 2015) | ~150 | ~125 |

| Dow Jones Total Stock Market Index | 21,500+ (Mar 2015) | ~15,000 | ~8,500 |

| U.S. Market Volatility Index (VIX) | 15 (Mar 2015) | 35 | 75-80 |

The 12 international variables capture the impact of a fall in real GDP growth, inflation, and the U.S./foreign currency exchange rate for the four country/region blocks of the Eurozone, the United Kingdom, developing Asia and Japan.

The underlying idea that clearly emerges on seeing these variables and their values is that if the financial institutions can hold their ground in such an extreme scenario, they will be well-positioned to withstand an adverse, but more probable scenario in the future.

How Did Each Financial Institution Do?

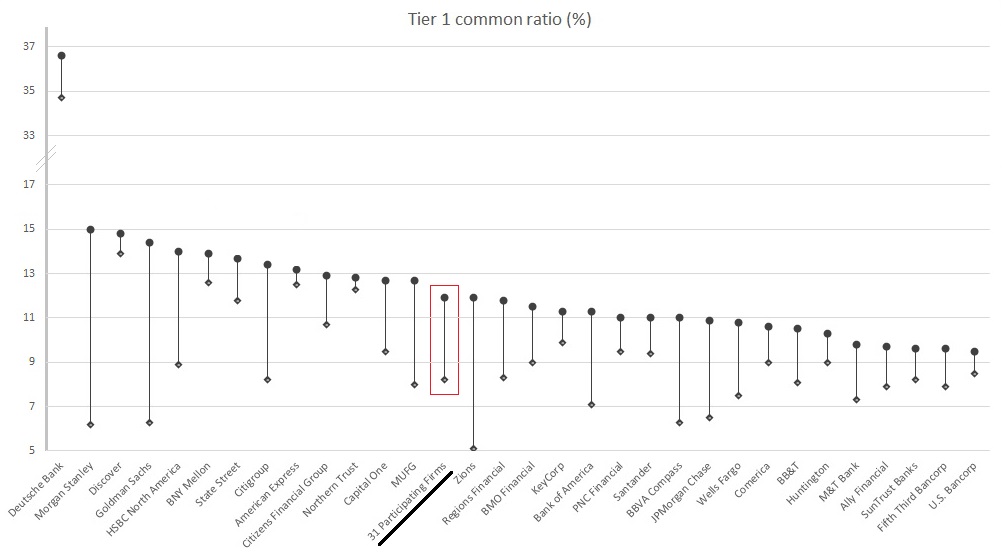

The key takeaway from the Fed’s stress test is the impact on Tier 1 common ratios for each of the 31 institutions tested under the severely adverse scenario. No doubt, each of the firms will see this benchmark figure fall from current actual values under the test conditions, but the amount it actually falls is governed by a firm’s business model, loan portfolio as well as the type of assets on its balance sheet. The table below represents the change in the Tier 1 common ratio for these firms from their current figure (circle) to their minimum level (diamond) as determined by the test for “severely adverse” situation.

The highlighted data point represents the combined performance of all the 31 participating firms. The lower end of the vertical axis is at 5% – the cut-off required for a firm to pass the stress test. With the Tier 1 capital ratio for all banks remaining above this figure even under the worst-case scenario, all of them cleared the quantitative round of the Fed’s stress test. Notably, Deutsche Bank’s results stand out in comparison to all other BHCs tested thanks to the fact that the U.S-based subsidiary that was tested represents only a small, low-risk part of the German banking giant’s diversified banking operations in the U.S.

There are some other interesting things to note here. Custody banks – State Street (NYSE:STT), BNY Mellon (NYSE:BK), Northern Trust – and card-focused lenders – Discover (NYSE:DFS), American Express (NYSE:AXP) – figure among the best-capitalized firms in the list, and are also the ones least affected by the test scenario. On the other hand, all the globally diversified banks – Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), HSBC (NYSE:HBC), JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC) and Citigroup (NYSE:C) – are seen at the bottom of the list in terms of worst minimum Tier 1 common ratios as the adverse scenario shaves off between four and nine percentage points from the benchmark for these banks. The test weighs heavily on Morgan Stanley in particular, as the investment bank slides from the second-best position in terms of current capital strength to the second-worst in terms of minimum capital ratios under severely adverse economic conditions.

What Does This Mean For These Banks Over The Coming Year?

As the second part of the stress test incorporates any corporate actions the banks proposed to undertake over the next year – including dividends, share repurchases and major acquisitions/divestitures – a bank which passes the test usually earns the Fed’s approval for its capital plan. There is an important exception to this, though, as the the Fed can still reject a bank’s capital plan due to some qualitative factor brought to its notice like it did in the case of Citigroup last year. While an increase in dividends and modest share buybacks are in the cards for most of the big banks, investors will be most interested in the capital return plans Bank of America, Citigroup and Morgan Stanley release on March 11, as these three banks have returned the least cash to investors since the economic downturn.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- Dodd-Frank Act Stress Test 2015: Supervisory Stress Test Methodology and Results , Federal Reserve Website [↩]