Why The Joint Venture With Cardinal Health Is A Good Move By CVS

In December 2013, CVS Caremark (NYSE:CVS) signed a 10-year agreement (50/50 joint venture) with Cardinal Health to form the largest generic sourcing entity in the U.S., which is the largest generic drugs market in the world. With the combined volume, as well as the sourcing and supply chain expertise of the two companies, the venture can help spur innovative purchasing strategies with generic manufacturers. The joint venture will source and negotiate generic supply contracts for both Cardinal Health and CVS Caremark. As part of the deal, CVS wil receive $25 million quarterly payments from Cardinal for 10 years, and the total after-tax present value of these payments is approximately $435 million. The venture will be operational starting July 2014.

Cardinal Health a leading health care services, providing pharmaceuticals and medical products to more than 100,000 provider and pharmacy locations each day. Operating over 7,500 retail stores, CVS is one of the biggest pharmacies and the largest pharmacy services provider in the U.S. The strategic alliance between the two companies will enhance each company’s leadership position in generic-drug distribution and sales, enabling them to negotiate better generic drugs price.

CVS Caremark is already the leader in generic drug sales, and we believe that the joint venture with Cardinal can help the company benefit more from the ongoing generic wave. [1]

Our price estimate of $70 for CVS Caremark is at a discount of approximately 10% to the current market price.

View our detailed analysis for CVS Caremark

The U.S. Market Has Shifted Towards Generics

In the last few years, the U.S. market for medicines has shifted more towards generic drugs as a significant number of patents expired for major brand names. The branded pharmaceutical business has seen tens of billions removed from the market annually by patent expiry. [2]

The total generic dispensing rate, which factors the percentage of generic drugs in a consumer’s prescription, grew to 78.5% in 2012, from 74.1% and 71.5% in 2011 and 2010, respectively. The generic wave peaked in Q1 2013 and hit a trough in Q1 2014. Despite slower substitution in the last few quarters, an estimated $15 billion worth of branded products will come off patent in the next two to three years, opening them to competition from generic drugs. [3]

CVS Caremark’s Generic Purchasing Power To Increase To $10 Billion

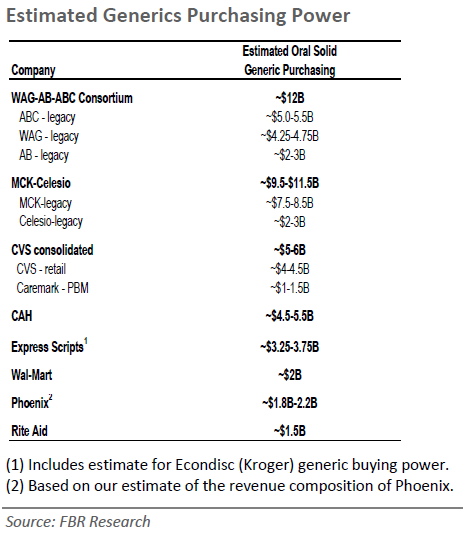

Walgreen (NYSE: WAG) recently entered into a 10-year agreement with AmerisourceBergen (ABC) to jointly source generic drugs and generate logistical efficiencies. Post the deal, the combined generic purchasing power of the two companies is estimated to be around $12 billion. Soon after Walgreen-ABC linked their sourcing operations, McKesson put a bid to buy Celesio, a German distributor and drug retailer. The combined generic purchasing power of McKesson and Celesio is estimated to be between $9.5 billion to $11.5 billion. Currently, CVS has a generic purchasing power of $5-6 billion. The joint venture with Cardinal is estimated to increase the combined global generic purchasing power of the two companies to approximately $10 billion, helping CVS better compete against in the industry.

Generic drugs are comparatively lower priced but offer higher gross margins (approximately 50% higher) than branded drugs, for both wholesalers and retailers. The joint venture with Cardinal will help CVS develop more efficient and cost effective purchasing strategies with generic manufacturers in the U.S. With leading players collaborating with each other, the lower number of buyers in the industry can put pressure on gross margins of generic manufacturers, forcing them to lower the prices even further. Retailers (such as CVS) in turn can pass on this cost saving to retail customers.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) | Get Trefis Technology

Notes:- CVS Caremark Makes Another Good Deal, The Motley Fool, December 19 2013 [↩]

- Cardinal Health and CVS Caremark strike a deal on generics distribution, Pharmaceutical Commerce, December 12, 2013 [↩]

- CVS Caremark’s CEO Discusses Q2 2013 Results – Earnings Call Transcript, Seeking Alpha, August 6, 2013 [↩]