Constant Contact Q4 ’14 Earnings Preview: Toolkit And SinglePlatform Will Continue Driving Revenues

Constant Contact (NASDAQ: CTCT), the digital marketing service provider for SMEs (Small and Medium Enterprises), is set to release its fourth quarter earnings on January 29th. The company displayed a 16% year-on-year growth in its revenue to $243 million for the first nine months of 2014. The introduction of Toolkit as an “integrated online marketing suite” in the first quarter of 2014, coupled with SinglePlatform’s (Constant Contact’s digital listing service) display of 100% year-on-year top line growth, are the primary reasons for Constant Contact’s revenue growth. The healthy top line growth trickled down to the bottom line too, with Constant Contact registering a whopping 200% year on year growth of net income to $8 million. Gross margins showed a 150 basis point improvement while net margins displayed a 200 basis point growth for 9M FY14, versus the prior year. [1]

The three revenue drivers for Constant Contact are: new customer additions, Average Revenue Per User (ARPU), and customer retention. For the first nine months of 2014, Constant Contact performed well in terms of all three drivers. The company experienced 50,000 gross new unique customer additions for each of the first three quarters of 2014. The customer base stood at 625,000 at the end of the third quarter of 2014 (7% year-on-year growth). The ARPU for Q3 2014 increased to $44.89 displaying an 8% year-on-year growth. Customer retention stood at approximately 98%. [2] Based on September and October results, Constant Contact’s management expects the ARPU in the fourth quarter to reach the $46 to $47 range. [3] The management believes that the main reasons for ARPU acceleration would be: 1) continued gains from Toolkit, 2) a seasonally strong quarter, 3) refinement in pricing, 4) migration of existing customers to Toolkit, and 5) SinglePlatform’s continued growth.

- Endurance Finalizes Constant Contact Acquisition, Lays Off 15% Of The Staff

- Constant Contact Earnings: Results Were Good Year-On-Year But Fell Short Of Guidance

- Constant Contact Pre-Earnings: Improved Marketing Strategies, Continued Alliances And ‘Galileo’ Could Drive Revenues

- Constant Contact: What Lies Ahead

- Constant Contact Performed Better Than The Previous Quarter, Though Customer Growth Yet To Recover

- Constant Contact Q2 Earnings Preview: Recovery Expected Post The Change In Brand Positioning

The company’s full year revenue guidance lies between $331 million to $331.4 million, with a 16% year-on-year growth. Adjusted EBITDA margin is expected to be at 18.2%, representing a 200 basis point increase year to year. For 2015, Constant Contact expects revenues and EBITDA margins to grow year on year by 17% and 150 basis points, respectively.

Our price estimate of Constant Contact at $30.45 is at around 20% discount to the current market price.

See our complete coverage of Constant Contact

In Line With Its Previous Performance, Toolkit Is Expected To Positively Impact The Q4 Earnings Too

Toolkit helps small businesses and non-profit organizations to launch multiple campaign types across high-return marketing channels, such as email, social media, mobile access and the Web. This bundled offering has three different packages: Basic, Essential and Ultimate. The base versions of these packages are priced at $20 a month, $45 a month and $195 a month respectively, and have limited contact list sizes. In addition to the differential pricing on these base packages, the company also has a contact list-based pricing structure across all three packages that is priced upon the underlying base package. So far, the developments and impacts related to Toolkit are as follows:

- Improved customer engagement, higher ARPU, increased retention rates, and increased lifetime customer revenue has been observed from Toolkit’s customers. The company is on a path of rapid transition where it is refining the positioning, selling, onboarding, and product experience to expand the customer base and improve the lifetime customer value.

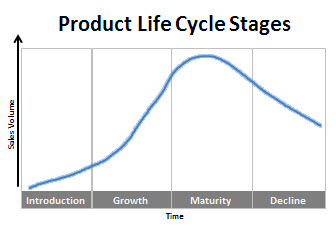

- The product ‘Toolkit’ is still in the Growth stage of its life cycle and Constant Contact is undertaking constant iterations till the most optimum solution is reached.

(Source: Product Life Cycle Stages)

(Source: Product Life Cycle Stages)

- Constant Contact is planning on renaming the basic package as the E-mail package, in order to clarify the popular misconception that Constant Contact only provides E-mail marketing related services, and hence improve customer conversions. With Toolkit’s introduction, Constant Contact has broadened its scope of service offering beyond email marketing, and consequently attracted more customers and driven up the ARPU. There are also plans to add advanced automation and market savvy features into different packages.

We believe, the Toolkit introduction has been a growth driver for Constant Contact and the company will reap its benefit in the fourth quarter, and in the future as well.

SinglePlatform Should Boost The Q4 Earnings, As Well

Constant Contact’s digital listing service, SinglePlatform, retained its growth momentum by registering an above 100% top line growth year-on-year, with significant growth for all the revenue drivers. For the first nine months of 2014, its enterprise channel has accumulated over 4,000 customers. It has expanded its client base beyond the restaurant vertical to spas and salons, yoga studios, florists, pet care etc. SinglePlatform was chosen by Facebook in Q2 2014 as the platform to display menus, specials and other information for restaurants in the US and Canada. Hence, millions of Facebook users in the US and Canada will access SinglePlatform in seeking the pages of restaurants in which they have an interest. Also, SinglePlatform gained 11 enterprise deals, each with above 100 locations, in the second quarter.

Constant Contact’s Affordable Marketing Tools And Constant Upgrades Will Keep Drawing In New Customers

Email marketing’s popularity was evident for Constant Contact recently, as it recorded its largest email send day on Cyber Monday 2014, when it sent more than 365,000,000 emails. Constant Contact’s typical customers are small businesses, which lack dedicated budgets marked for marketing initiatives. As opposed to traditional offline marketing solutions, online marketing tools provide businesses with immediate impact on a large scale at low prices. The prospects of gaining a wide reach with relatively low spending is driving growth for digital marketing among small enterprises. The growth of digital marketing in turn will continue boosting Constant Contact’s growth in sales and profitability.

The improving economic scenario in the domestic U.S. market could help small and medium enterprises build scale. Constant Contact caters primarily to the SME business space, and should be able to leverage upon the growth of the U.S. small and medium enterprise market, to dynamically grow its own ARPU levels going forward.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- Constant Contact Form 10-Q for the period ending September 30, 2014 [↩]

- Constant Contact Announces Third Quarter 2014 Financial Results, Constant Contact, October 2014 [↩]

- Constant Contact’s Q3 2014 earnings call transcript, Seeking Alpha, October 2014 [↩]