Keep Calm, AB InBev’s Firm Offer For Acquiring SABMiller Is Coming

Anheuser-Busch InBev (NYSE:BUD) has finally gone public with its efforts to take over SABMiller, a combination that would bring the two biggest forces in beer under one umbrella. AB InBev unveiled a $104 billion proposal to buy rival SABMiller, which was swiftly rejected by the U.K.-listed company, citing that the offer considerably undervalued the brewing company. However, AB InBev still hasn’t made its firm offer, for which it has the deadline of October 14, according to the U.K. takeover rules. The Belgian brewer’s public disclosure is in efforts to stir discussions within SABMiller, and encourage shareholders to review the proposal and persuade the British brewer’s board to engage. Within a week’s time, a firm bid could be made, which could then shake up the dynamics of the global beer market, majorly.

We have a $120 price estimate for Anheuser-Busch InBev, which is above the current market price.

- What’s Next For Anheuser-Busch InBev (BUD) Stock After A 7% Fall This Year Despite Q4 Earnings Beat?

- Does Anheuser-Busch InBev Stock Have More Room For Growth?

- What’s Next For Anheuser-Busch InBev Stock After A 17% Rise In A Month?

- What’s Happening With Anheuser-Busch InBev Stock?

- Should You Buy, Sell, Or Hold Anheuser-Busch InBev Stock At $55?

- What’s Next For Anheuser-Busch InBev Stock?

See Our Complete Analysis For Anheuser-Busch InBev

Why SABMiller Doesn’t Want To Cave

SABMiller previously also rejected private bids of £38 and £40 a share from AB InBev. [1] The proposal made on Wednesday comes in two forms — one is all-cash, and the other is a mix of AB InBev shares and cash. The all-cash proposal is set at £42.15 ($64.80) per SAB share, which is a 44% premium on SABMiller’s price before the news of a potential AB InBev bid caused disruptions. The partial share offer is to attract SABMiller’s two top shareholders — Altria (27% stake) and Bevco, which manages the Santo Domingos’ 14% holding. Altria supports the present proposal, and its three SAB board members were the only ones who didn’t reject the proposal in the 15-member board.

The proposal values SABMiller at around £72 billion (more than $110 billion), including debt, while the current market capitalization of the company is just over $90 billion. The U.K. brewer believes that the merger would allow AB InBev to extract large benefits of cost cuts and synergies, which is why the set price is below expectations, in their opinion. The deal, if it goes through, would be the third-largest M&A transaction in history, after the Vodafone AirTouch- Mannesmann deal of $172 billion in 1999 and Verizon Communications-Verizon Wireless deal of $130 billion in 2013.

The Merger Will Be Haunted By Anti-Trust Issues

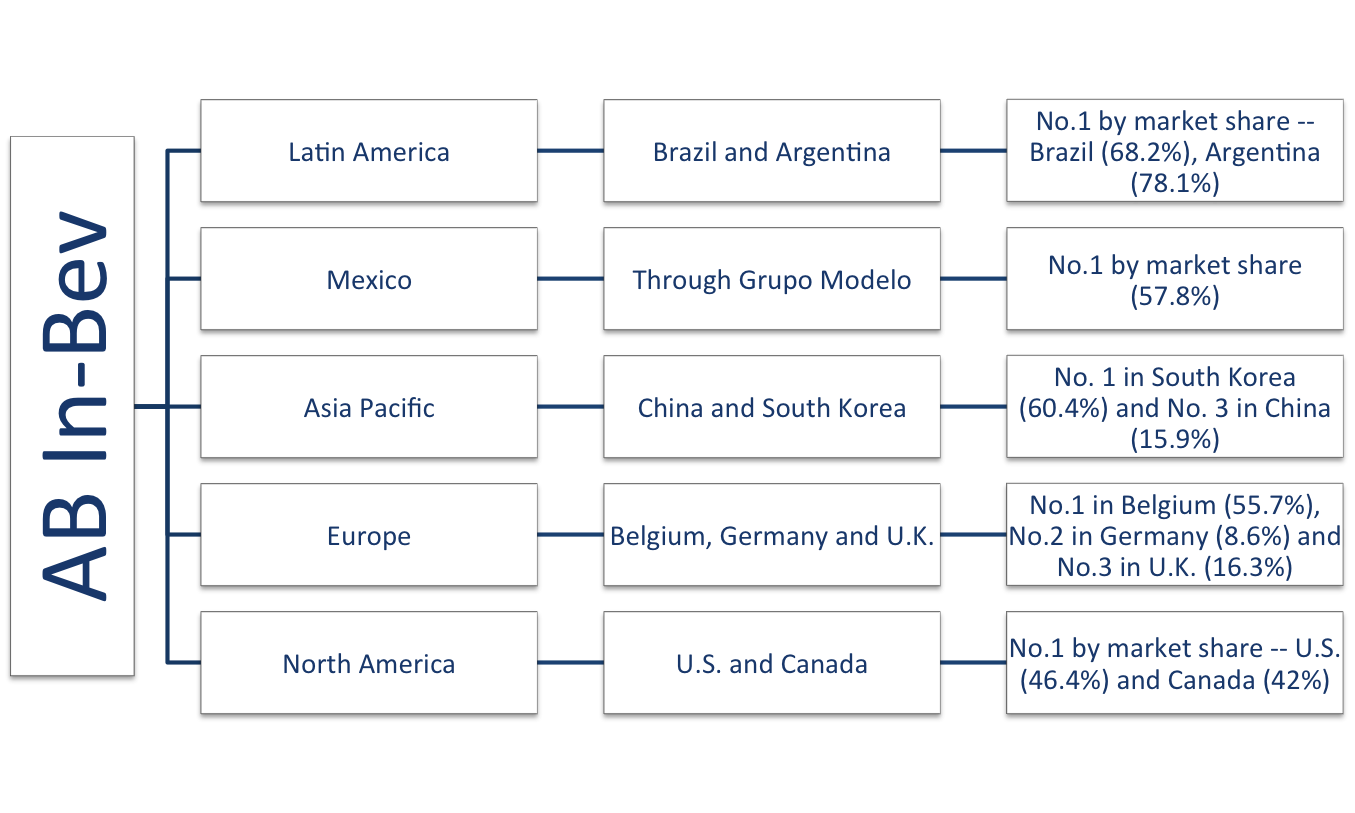

The coming together of the number one and two in global beer is bound to undergo antitrust scrutiny. Having both the likes of Budweiser and Miller under one roof would also mean that around 36% of the global beer volumes will be contributed by this single company (market shares of AB InBev and SABMiller were 21% and 15%, respectively, in 2014). AB InBev has pursued global expansion through strategic M&A activities, including the $20.1 billion acquisition of Grupo Modelo in 2013 and the Oriental Brewery takeover last year. But SABMiller will be a different ball game.

The combination between these two companies could take AB InBev to a point of strength in Africa, from having virtually no presence. SABMiller dominates the beer industry in that region, with ~30% of its revenues coming from South Africa and the rest of the continent, in the last fiscal year ended March 2015. In addition, SABMiller’s strong presence in countries such as Colombia (its third largest market) and Peru could further strengthen AB InBev’s already flourishing Latin America business. So there is a lot of new opportunity in terms of Africa and Asia, and synergies in Latin America, that fuel AB InBev’s interest in SABMiller.

However, there is also a lot of conflict of interest. SABMiller has a joint venture with Molson Coors in the U.S. called MillerCoors, which, after Anheuser, is the largest beer company in the country, holding ~25% market share. Anheuser has a 46% market share. The Miller-Coors partnership will be a point of conflict, and could lead to divestitures; divestitures that might not be the greatest strategic decisions, in hindsight. Anheuser had to give away Corona in the U.S. after the Grupo Modelo acquisition due to anti-trust policies, which has partly backfired as Corona, along with other Mexican imported brands, is one of the fastest growing group in the U.S. beer market. On the other hand, in China too, SABMiller has a joint venture called CR Snow, with China Resources Enterprise, which has a leading 23% volume share in the country’s beer market. Antitrust issues might call for Anheuser to sell off SABMiller’s partnership deals in the U.S. and China, which they would, most likely, rather not do.

The AB InBev-SABMiller potential partnership has a lot of roadblocks in its way, of course, given the scale of this deal. According to Euromonitor, the combined company’s market share would be ~29% after likely divestments, 20 percentage points more than the next-biggest brewer, Heineken. More will be known within a week’s time, but with the announcement of the proposal and its terms, AB InBev’s intentions to pursue global expansion through consolidation in the beer market have become more apparent.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

Notes: