How Will BP’s Production Grow Over The Next Five Years?

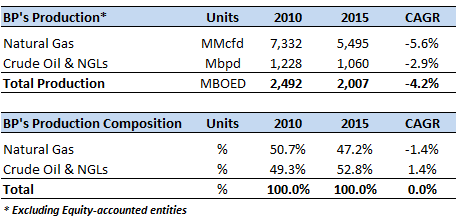

BP Plc. (NYSE:BP) is a UK-based integrated oil and gas company with proved reserves of 10.4 billion barrels of oil equivalent and operations in more than 70 countries. The company’s upstream operations, i.e. exploration, development, and production of oil and gas products, accounts for almost 30% of its total enterprise value. Despite its large proved reserves, the company’s production has been declining at a compound annual rate of over 4% over the last five years and averaged at a little over 2,000 MBOED (thousand barrels of oil equivalent per day) in 2015. The primary reason for this sharp drop is the commodity downturn that began in mid-2014, which resulted in a steep fall in the company’s price realizations, forcing it to pull back its oil and gas production.

Apart from this, the company’s reserves replacement ratio, which describes the extent to which the current year’s production has been replaced by proved reserves, has been diminishing. The ratio fell from 103% in 2011 to 61% in 2015, implying that the company has been unable to replenish its reserves at the same rate as its production over the last few years.

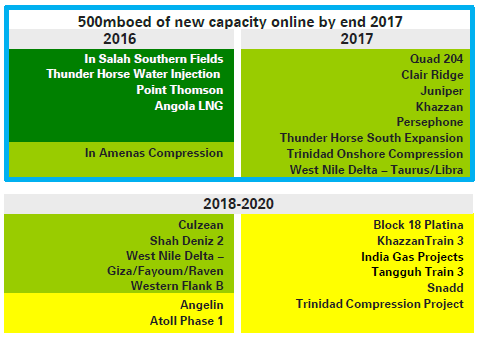

However, in order to weather the current commodity downcycle and sustain its upstream operations, BP has invested in a number of projects that are expected to come on-stream between 2016 and 2020. The London-based company aims to add approximately 800 MBOED of new production capacity to be added to its existing portfolio by 2020. Of this, roughly 500 MBOED of new production capacity is estimated to be in place by 2017. The company seems to be on track to achieve its target, since almost 70% (on an average) of its planned projects for the 2016-2017 time frame are already complete. Below is a snapshot of the projects that BP plans to bring on-stream over the next few years.

BP’s Project Pipeline – 2016-2020

Source: BP’s Project Presentation, June 2016

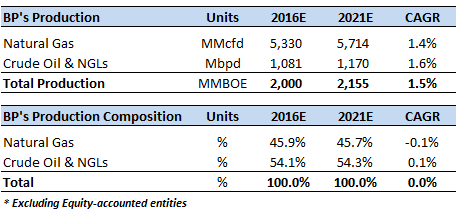

While the company has a very ambitious project pipeline, the ongoing oil slump may cause a hindrance for the company to realize the actual upside from these projects. We expect the crude oil prices to remain volatile for the rest of the year, and average at around $50 per barrel for the full year. Thereafter, we forecast the oil prices to recover gradually over the next few years. Based on our oil price estimate, we expect BP’s production to grow at a compounded growth rate of 1.5% annually over the next few years. However, the production growth could rise sharply based on the pace of recovery in oil prices in the coming years.

Have more questions about BP Plc. (NYSE:BP)? See the links below:

- BP Q1 Earnings: Revenues And Profits Suffer Due To Low Oil Price Environment, Cash Outflows Still Greater Than Inflows

- What’s BP’s Revenue & Earnings Breakdown In Terms of Different Products?

- What’s BP’s Fundamental Value Based On Expected 2016 Results?

- How Has BP’s Revenue Composition Changed In The Last Five Years?

- What Has Led To More Than 25% Decline In BP’s Revenues & EBITDA In The Last Five Years?

- By What Percentage Can BP’s Revenues Grow Over the Next Five Years?

- How Are BP’s Revenue & EBITDA Composition Expected To Change By 2020?

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for BP

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap