Anadarko Petroleum: Acquisition In The Cards?

Even as the current fiscal year draws towards an end, the mergers and acquisitions (M&A) in the oil and gas industry have not ceased a bit. As the outlook for commodity prices remains bleak, independent exploration and production (E&P) companies, that are struggling to sustain business in the current downturn, have become more vulnerable to takeovers. Anadarko Petroleum (NYSE:APC), for instance, has been in the news lately due to its susceptibility to either acquire or get acquired by another E&P company in this challenging environment. In this note, we briefly discuss how Anadarko has been a potential target for some of these deals.

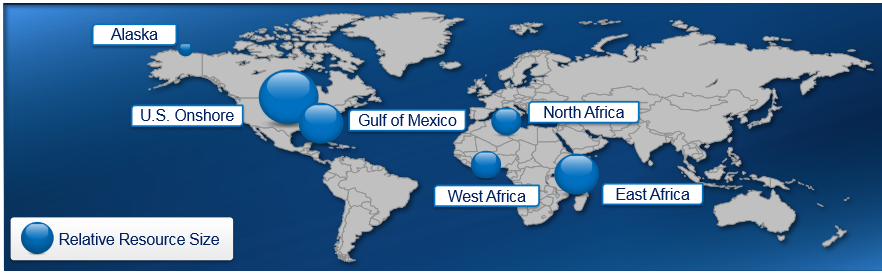

Anadarko’s Resource Potential

Source: Barclays 2015 CEO Energy Power Conference, September 2015

Anadarko Petroleum is a US-based oil and gas producing company having the majority of its onshore assets in the Permian Basin, which are considered to be among the most economical oil plays in the US. However, this has made the company highly reliant on commodity prices. As the oil and gas prices have touched multi-year lows over the last few quarters, the company has witnessed a drastic fall in its bottom line. Anadarko reported a consolidated loss of $5.4 billion in the first nine months of 2015 as opposed to a loss of $1.3 billion in the same period last year. In consequence, almost 38% of the company’s market capitalization has been washed away since the beginning of this year. Since the Organization of Petroleum Exporting Countries (OPEC) decided earlier this month to maintain its record high levels of oil production, the recovery in oil prices has been delayed to at least the second half of 2016. As a result, the valuation of oil and gas producers has dropped significantly. This is a strong reason to worry for companies like Anadarko, though these could potentially become a target for an acquisition if the commodity prices do not rebound in the near future.

- How Will Anadarko Perform In 2019?

- Andarko 4Q: Andarko To See Improved Earnings But Cash Flow May Face Headwinds

- Anadarko Has Been Trading At A 52-Week Low. Where Will It Head Going Into 2019?

- Higher Oil Output And Improved Commodity Prices Will Drive Anadarko’s 3Q’18 Results

- Ramp Up Of Oil Production Will Drive Anadarko’s Value In The Near Term

- Key Takeaways From Anadarko’s Second Quarter Results

Source: Google Finance; S&P Dow Jones Indices

In order to avoid such a situation, Anadarko proactively extended an all-stock bid to acquire Apache Corporation (NYSE: APA) in November this year. However, Apache’s management felt that the price offered by Anadarko was low and was not in the best interest of the company’s shareholders. Hence, the offer was rejected. Not only did this bring down Anadarko’s stock price by almost 4% within a single trading day, the news was seen as a desperate attempt by the company to save itself from a potential acquisition. By acquiring Apache, which is one of the biggest leaseholders in the Permian Basin, Anadarko would have expanded its exposure to crude oil. This would not have been a good move under the prevailing low oil prices. As a result, despite the high quality assets and strong historical performance, the investor confidence in the company has diminished, which is evident from the 16% dip in the company’s stock over the last month.

See Our Complete Analysis For Anadarko Petroleum Here

Rather than working as a defense for Anadarko, this half-hearted move made the company more vulnerable to a potential acquisition in this commodity down cycle. According to the rumor mills, the company was approached by Chevron for an acquisition at a price of $83 per share in October this year. However, the two companies did not confirm the news. Earlier this week, there were speculations that China Petroleum & Chemical Corp. (NYSE: SNP), commonly known as Sinopec, is planning to acquire Anadarko. Sinopec is a much larger company with exposure to natural gas and crude oil. The possible deal is likely to provide the company access to Anadarko’s rich oil assets and inventory in the Permian Basin. On the other hand, the deal will provide financial support to Anadarko, which will enable the company to weather the current oil slump. Thus, the deal, if it comes true, could be a win-win for both the companies.

While there is no definitive announcement by the company as of now, we figure that Anadarko, like other independent E&P companies, is susceptible to an acquisition if the commodity prices continue to remain depressed for long.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap