Can AMD Sustain Its Share Gain In Discrete GPUs?

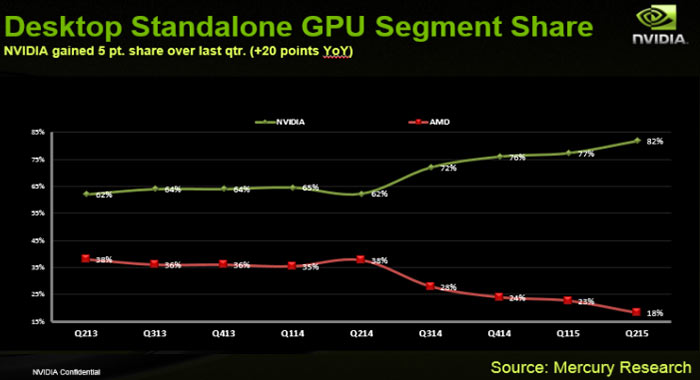

According to a recent report by Barron’s, graphics processor unit (GPU) manufacturer AMD (NYSE:AMD) managed to gain share in the discrete GPU market from its arch rival Nvidia (NASDAQ:NVDA), this far in Q3 2015. (There are two more weeks left for the quarter to end). While the extent of the share gain is not confirmed yet, it is still encouraging news for AMD’s investors given that the company’s discrete GPU market share hit rock bottom in Q2 2015. GPUs account for between 20% and 25% of AMD’s total revenue, and providing graphics for PC gaming is an integral part of the company’s long-term growth strategy.

Whether AMD can continue gaining share in the discrete GPU market in the next few quarters is yet to be seen. It would be a stark reversal of the declining trend it has seen in the last many quarters. We forecast a marginal increase in the company’s discrete GPU market share (both notebooks and desktops) in the long run.

Our price estimate of $2.43 for AMD is at an approximate 30% premium to the current market price.

- How Will AMD’s AI Business Fare In Q1?

- Digital Infrastructure Stocks Are Up 7% This Year, Will Generative AI Tailwinds Continue To Drive Them Higher?

- Up 130% In The Last 12 Months, Will AI Power AMD’s Rally Post Q4 Results?

- AMD Takes The Fight To Nvidia With Latest AI Chip Launch. Is The Stock A Buy At $116?

- Is AMD Stock A Buy At $120 As It Doubles Down On AI-Focused GPUs?

- Is AMD The Dark Horse Of The AI Silicon Race?

See our complete analysis for AMD

The Graphics War Between AMD and Nvidia

Following AMD’s acquisition of ATI in 2006, the discrete graphics cards industry has had only two key players – Nvidia and AMD. The two companies account for almost 100% of the GPU market. The market shares of the two companies have fluctuated a lot between quarters, but Nvidia still manages to retain its lead over AMD in the discrete GPU market.

Nvidia has pursued architecture updates aggressively and more quickly placed them in products, while AMD — strapped for resources as it tries to compete with Intel in CPUs and Nvidia in GPUs — has fallen back on re-branding existing chips in many of its cards. AMD has often resorted to slashing its prices in the past in order to better sell its graphics chips.

What Led AMD’s Discrete GPU Market Share To Decline Below 20% In Q2’15

AMD’s market share in discrete graphics touched an all-time low of 18% in Q2 2015. In the last few quarters, AMD was in the process of reducing its inventory to get rid of its old generation GPUs and make way for its upcoming GPU lineup. The company recently launched a number of new products — Radeon 300 series and the Fury lineup (Radeon R9 Fury X, R9 Fury and R9 Nano discrete graphic cards) — which started selling in late Q2 2015. The Fury graphics family marks a turning point in PC gaming with the implementation of High-Bandwidth Memory (HBM) to deliver extreme energy efficiency and performance for ultra-high resolution, unparalleled VR (i.e., Virtual Reality) experiences, and smoother gameplay. Thus, the inventory correction and the fact that AMD launched its new GPU lineup towards the end of Q2 2015 are possible reasons for the company’s market share stooping to below 20%.

AMD completed its inventory correction last quarter, which coupled with rising sales of its new GPU products led to an increase in its discrete GPU market share in Q3 2015. Additionally, the company benefited from Nvidia’s lack of support for async compute, one of the three highlighted features of Direct3D 12. This could have been a possible reason for many Nvidia users shifting to AMD graphics, which support this feature. (Read more on this topic here)

Nvidia Continued To Hold The Lead In The Premium Segment In Q3’15

According to Barron’s, AMD gained market share in the $200 and $400 price range, which includes the R9 380 and R9 390X cards, while NVIDIA still holds the lead in the premium $500+ segment. AMD’s Fury lineup is part of the high end range. While the Radeon R9 Fury card is widely available in the market, AMD’s R9 Fury X (official price of $650) has been in short supply and has been selling at a premium to its original price. On the positive side, at least AMD is seeing strong demand for these chips. One reason for the short supply could be that AMD is focusing on rolling out Radeon R9 Nano, which was launched in late August this year and is more margin accretive for the company than R9 Fury X. [1]

HBM is a relatively new technology and may take time to scale up, but is likely to hit regular supply in the near future. Once supply evens out, we expect AMD to see higher volume of sales for both Radeon R9 Fury X and Radeon R9 Nano. This can help the company regain some of its lost market share in the premier high-end segment as well in the coming quarters.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- AMD R9 Fury X In Short Supply – Selling For Up to $899, Used Cars For Over $651, WCCF Tech, September 2015 [↩]