Is Colgate a Buffett Type Stock?

Earlier this month, Colgate-Palmolive’s (NYSE:CL) name was volunteered by prominent fund managers Whitney Tilson and Douglas Kass as a potential target for Warren Buffett’s elephant gun. Instead the Oracle chose a $9.7 billion deal for Lubrizol (NYSE:LZ), a leading global supplier of additives to transportation and industrial lubricants. [1] Here we explore what makes Colgate compelling for value hunters and compare it to competing consumer stocks like Unilever Group (NYSE:UL), Revlon (NYSE:UL) and L’Oreal (PINK:LRLCY).

Necessities are here to stay

- Should You Pick Colgate-Palmolive Stock Over Monster Beverage After The Latter’s 2x Gains This Year?

- Should You Pick Colgate-Palmolive Stock After A Q3 Beat And 4% Gains This Month?

- Is Colgate-Palmolive Stock A Better Pick Over Marriott?

- Which Is A Better Consumer Defensive Pick – Kimberly-Clark Or CL Stock?

- Should You Buy Colgate-Palmolive Stock At $80?

- Should You Buy This Households & Personal Products Company Over Colgate-Palmolive Stock?

Colgate is one of the leading players in personal care products with presence in over 200 countries across the globe. The Colgate brand is synonymous with toothbrush and toothpaste, making it the global leader of the $20 billion market of oral care products with close to a 34% market share.

It also has a portfolio of leading household brands such as Ajax and Palmolive soaps as well as various shampoos and deodorants. As the global economy recovers from the downturn over 2007-09, market watchers question where giants like Procter & Gamble (NYSE:PG) and Unilever (NYSE:UL) can sell enough products to move the needle. Will big investments in higher volume, lower margin emerging markets be the right source of growth?

Given Berkshire’s holding period, which is forever, economic downturns or the slow pace of economic growth are opportunities to snap up good companies when share prices are depressed. Consumer staples and necessities gel well with Buffet’s overall investment criteria of strong free cash flow, low debt and wide moats. It then comes as no surprise that Buffet already has a substantial stake in Procter & Gamble and has avoided technology stocks where Buffett feels less comfortable on the visibility of future earnings.

Colgate’s sound fundamentals

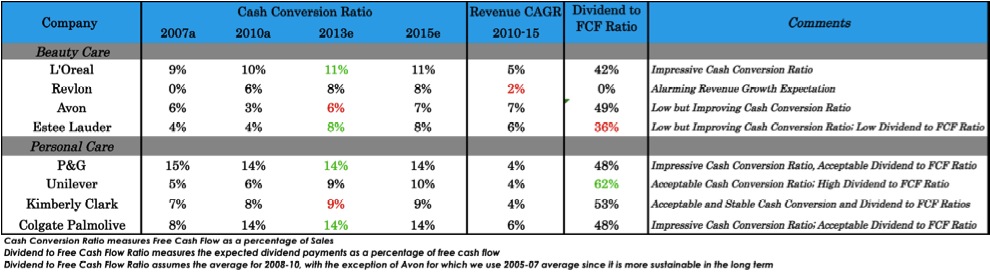

Colgate’s EBITDA margins in excess of 25% are well ahead of most competitors and the company exhibits operational efficiencies. We can compare this with Unilever, which has EBITDA margin fluctuating around 15% from 2005 to 2010. Colgate has reduced leverage from a debt to equity ratio of 2.5 in 2005 to 1.2 in 2010. The corresponding debt coverage ratio has climbed from 19 to almost 71 over the same period. What’s more, Colgate has an impressive cash conversion ratio (free cash flow % sales) of 14%, well ahead of many of its peers. Berkshire-type investments essentially constitute rich cash generating businesses, which have the capacity to plow back earnings for further expansion or pay to shareholders in dividends. Colgate leads the pack in terms of its sound cash generation and healthy capital structure with low leverage and could make an interesting choice.

See our full analysis of Colgate-Palmolive.

Notes:- Buffet’s obvious $10 billion bet, MSN Money, March 16′ 2011 [↩]